If you have suffered a head or facial injury and you think you are entitled to compensation, we at Thomas W Enright Solicitors can submit an application for compensation on your behalf to the Personal Injuries Assessment Board, now known as the Injuries Board.

If the person or organisation you are claiming against agrees to the assessment of your claim, the Injuries Board will assess the amount of compensation due to you based on the report of your doctor and according to what is called the Book of Quantum.

We will guide you through the process from start to finish and deal on your behalf with the Injuries Board as well as your doctors and other professionals as might be required. We will explain the procedure to you and try to make it as simple and straightforward as possible. When your claim has been assessed we will provide you with advice in order to help you decide on whether or not to accept the compensation offered.

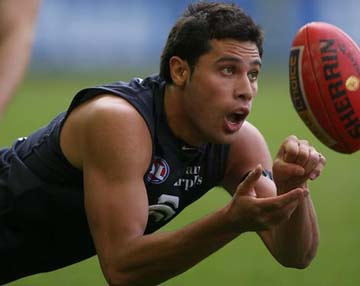

If you have suffered a head injury - which includes a concussion and a skull fracture - and no other part of the body is affected, the level of compensation you will receive will depend on the severity of the injury.

The level of compensation for an eye injury is determined on the basis of how the injury has affected one's sight and whether it involves one or both eyes. For the total loss of sight in one eye the guideline compensation figure is €138,000.

For loss of hearing, compensation is determined according to the formula in the so-called Green Book.

Compensation for dental injuries takes into account the number of teeth affected, whether they are permanent or milk teeth and whether they are lost or damaged.

For other head and facial injuries, severity is divided into the following broad ranges to reflect the degree of disruption to your lifestyle and the pain and permanency of your condition:

• Minor

• Moderate

• Moderately severe

• Severe and Permanent